BUSINESS

Well-diversified and global industrial group focused on the power engines manufacturing and energy industries.

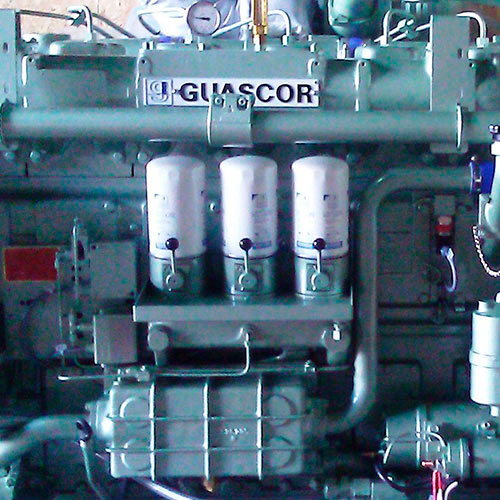

Its diverse activities include: (1) manufacturing and operation of engines for power generation in isolated areas and for environmental applications, (2) operation of own power generation plants in Spain and Brazil and (3) wind, solar and biomass power industries.

DEAL STRUCTURE

Acquisition of a 13% equity stake in 2006 for € 21 million (€ 11 million Diana Capital and € 10 million from a co-investor: Axis- ICO).

Partnering with founder and management team of the Group.

INVESTMENT THESIS

Substantial demand for power engines in isolated rural areas in the world.

Expand energy business to capitalize on market opportunity.

High international growth potential.